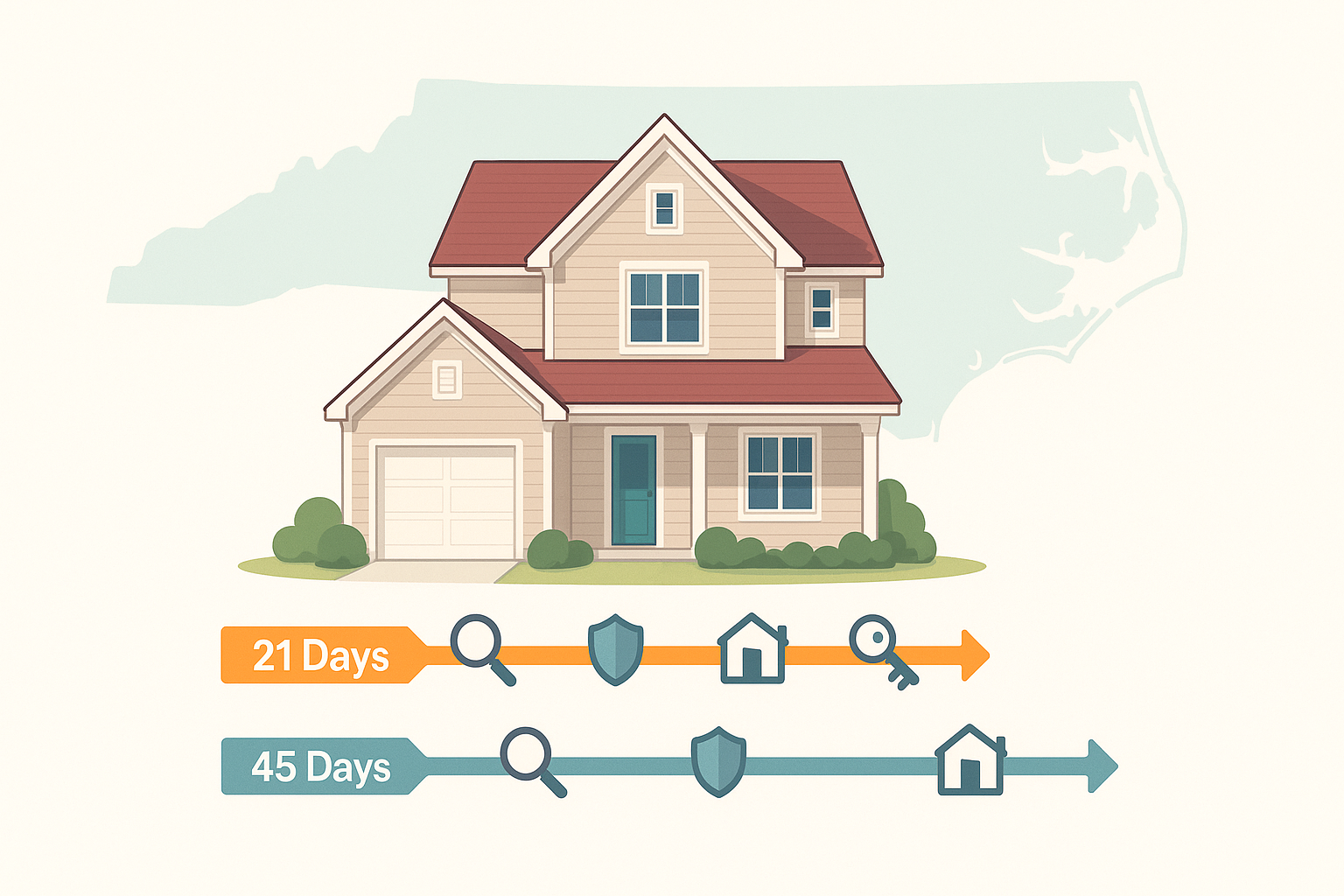

In North Carolina, closings typically take 30–45 days. But with the right prep, you can close in as little as 21. Here’s what really controls the clock—and how to keep it from dragging on.

What controls the closing timeline

Three moving parts set the pace:

1) Appraisal. The lender orders this, but scheduling depends on appraiser availability. Rural areas can add days.

2) Title and attorney work. North Carolina requires attorneys to review title and record the deed. That means no keys until the deed is recorded at the courthouse.

3) Insurance and lender docs. You need a homeowners insurance binder before clear-to-close. Lenders also verify employment and update credit right before closing.

For a step-by-step look, see the first-time buyer timeline guide.

21-day vs. 45-day closings

21–25 days: possible with clean credit, fast appraisal, quick insurance, and an attorney who records promptly. This pace requires buyers to respond to every lender request within hours, not days.

30–35 days: the “normal” NC closing window—enough time for appraisal, title, underwriting, and insurance without too much rush.

40–45 days or more: often linked to program rules (FHA/VA), construction loans, appraisal backlogs, or last-minute borrower changes.

Your NC closing map

Contract → Appraisal ordered → Insurance binder → Title work → Underwriting → Attorney review → Recording → Keys. The main snag? Late docs or missed responses. The fix is staying proactive.

Attorney state process explained

Unlike “escrow states,” NC requires a real estate attorney to manage the closing. They handle the title search, prepare closing disclosures, and record the deed. No deed recorded = no keys.

This protects buyers from title defects and ensures funds transfer properly, but it adds a day or two compared to non-attorney states. Attorneys also coordinate with lenders to finalize numbers.

What speeds or derails closing

Quick pointers:

- Appraisal lag. Order early. A rush fee may be worth it.

- Insurance delays. Shop HOI as soon as you’re under contract.

- Title hiccups. Old liens or estate issues add weeks. Attorneys catch these early if looped in fast.

- Buyer changes. New credit cards, job shifts, or large transfers can blow up underwriting. Avoid until after closing.

- Communication gaps. Silence between lender, attorney, and agent slows everything.

Want the other side of the coin? See 10 ways to kill your loan.

NC loan type differences

Conventional/FHA/VA: often fastest, 21–30 days with clean files. FHA and Conventional can be quicker with rushed appraisals.

Non-QM: often fastest, 21–30 days. Depends on loan type, income type, etc.

Construction-to-perm (C2P): usually 45-60+ days due to added documentation, builder requirements, and inspections.

FAQ

Need a 21–25 day close?

I’ll show you exactly what to tighten so you can move faster without losing peace of mind. Attorney, appraisal, insurance, lender—we’ll line it all up.

Questions first? 984-289-6479 · wolff@michaelthebroker.com