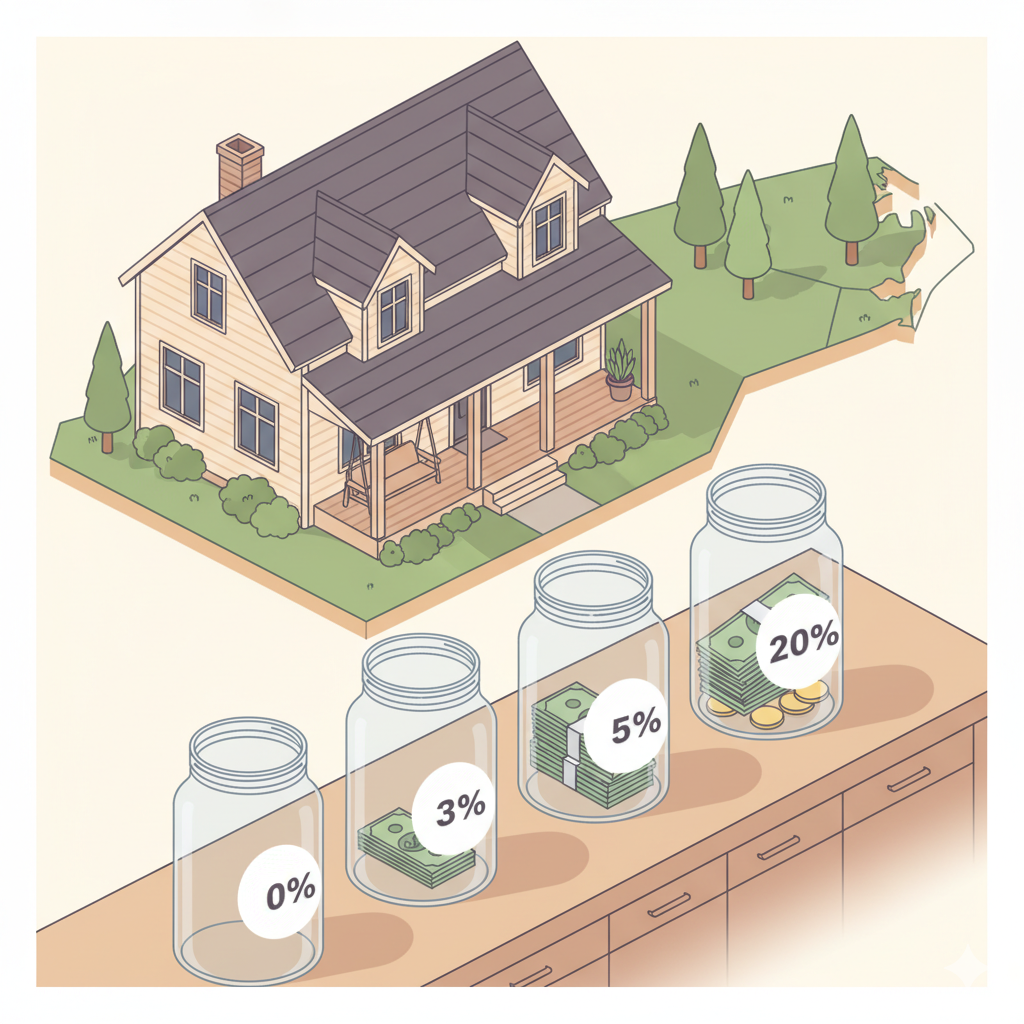

You don’t need a giant pile of cash to buy in NC. Here’s how 0%, 3%, 3.5%, and 5%–20% down actually change your monthly payment, mortgage insurance, and cash-to-close for $400k–$500k homes in Wake County—clear, calm, and no fluff.

What “down payment” really changes

Three levers move when you change your down payment:

1) Monthly payment. Lower down means a bigger loan amount, so principal and interest rise. Some programs also add or remove monthly mortgage insurance (MI).

2) Mortgage insurance. Conventional loans use private mortgage insurance (PMI) that can be canceled later. FHA uses mortgage insurance premium (MIP) that lasts longer. VA has no monthly MI. USDA has a small monthly fee built into the program.

3) Cash-to-close. That’s your down payment plus closing costs and prepaids (taxes, insurance, interest). Credits from the seller or lender can reduce this number.

When to choose more or less down

Choose a smaller down payment if your priority is getting the home while prices or rents keep rising, you want a cushion for repairs, or you need strength for appraisal gaps and earnest money. Down Payment Assistance (DPA) can reduce cash-to-close; it usually comes with income/credit rules and sometimes higher costs—use it when it helps you win safely, not just to stretch.

Choose a larger down payment if you want a lighter monthly payment, you plan to stay put for a while, or you want to remove monthly MI sooner (or immediately at 20%).

Curious about program tradeoffs? Read Are First-Time Home Buyer Programs Worth It? for plain-English pros, cons, and alternatives.

Common triggers: lease end dates, a new job start, a baby on the way, school calendar shifts, or a seller who prefers faster closes and stronger cash reserves.

Your loan timeline at a glance

Pre-approval → Home search → Contract → Lock window → Appraisal → Underwriting → Clear-to-close. Most snags come from missing documents or last-minute credit changes. The quick fix: keep your employment/credit steady and send docs fast.

How the loan math works (plain English)

Loan-to-Value (LTV) is the loan divided by the price. Higher LTV usually means a higher payment and, on many programs, monthly MI.

PMI vs. MIP vs. funding fee: Conventional PMI is monthly and can drop later. FHA MIP is monthly and lasts longer. VA uses a one-time funding fee instead of monthly MI (many veterans with disabilities are exempt). USDA charges modest upfront and monthly fees built into the program.

Rate vs. points vs. MI trade: You can lower the rate by paying points, or use a slightly higher rate to create lender credits to offset closing costs. You can also “buy out” MI on some conventional loans. The best mix depends on how long you’ll keep the loan. For rate basics, see the primer on the truth about mortgage rates.

Program details live in each agency’s handbook (see FHA Handbook 4000.1 for example). Use handbooks for rules, not pricing.

Common traps and tradeoffs

Quick hits to keep you safe:

- Emptying savings for 20% down. A low payment is nice; zero cushion is not. Homes want repairs when you first move in.

- Ignoring PMI cancellation. On conventional loans, PMI doesn’t have to be forever. Track equity and ask about removal.

- Forgetting closing costs. Budget ~2%–3% of price for fees and prepaids; seller credits or rate choices can offset some of this. For a refresher, see the note on hidden costs most buyers miss in Raleigh.

- USDA geography and income limits. Great pricing, but eligibility matters. Verify early.

- DPA fine print. Awesome when it closes the gap; read income/credit terms and any added fees or recapture rules.

- Comparing programs by rate alone. Total monthly and total cash-to-close tell the real story.

Wake County context: $400k–$500k realities

At $400k, a 5% conventional down payment often threads the needle: competitive offer, manageable cash-to-close, and PMI that can drop as equity builds. At $500k, buyers with strong credit might compare 3% conventional (lowest cash-in) vs. 3.5% FHA (often easier on credit/debt ratios) vs. VA 0% if eligible—no monthly MI and strong buying power.

If you’re stretching for location (inside Beltline, near RTP, or school targets), a smaller down payment can free up funds for appraisal gaps and early fixes without wrecking your monthly comfort.

FAQ

Want a plan that matches your timeline?

I’ll work up loan options that fit your goals, needs, and qualifications—so you’re never squeezed into the wrong program. Clear paths. Real numbers. Calm decisions.

Prefer to talk? 984-289-6479 · wolff@michaelthebroker.com