Builder incentives look generous until you run the real math. Smart Triangle buyers decode the true costs, compare financing paths, and structure deals that actually save money over time.

The incentive landscape in Triangle new construction

Triangle builders package incentives to steer you toward their preferred lenders and upgrade packages. Common offers: $10k toward closing costs, $15k in upgrade credits, or rate buydowns that look like steals.

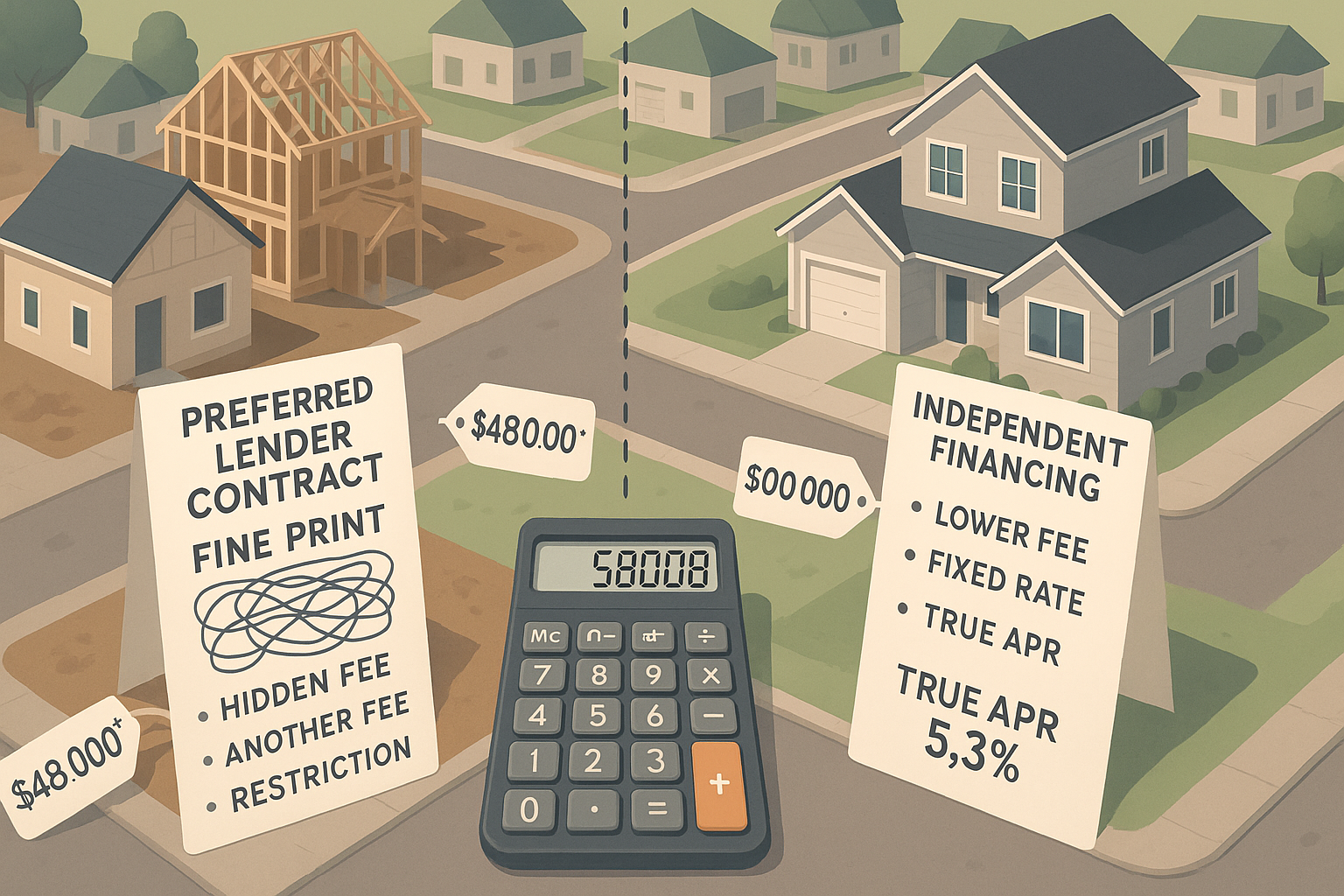

The reality: these aren’t gifts. Builders build these costs into home prices rather than dropping the base price, and preferred lender agreements typically don’t offer the best terms available in the market. You’re essentially paying for your own incentive through inflated pricing.

Contract trap: Builder agreements often make switching lenders difficult with tight deadlines, specific approval requirements, and penalty clauses. The incentive becomes leverage to lock you into financing that may not serve your best interests.

Quality consideration: Builders offering the largest financial incentives may cut corners elsewhere—construction quality, lot selection, or customer service. High-incentive builders sometimes prioritize volume over craftsmanship.

Preferred lender math: incentives vs true APR

Builder preferred lenders rarely offer the best available rates or terms. The incentives exist specifically to make subpar financing look attractive. When you see “$10k closing credit,” ask: why not reduce the home price by $10k instead?

The answer: pricing psychology. A $450k home with $10k incentives feels better than a $440k home, even though you’re financing the same amount. Meanwhile, the preferred lender charges 0.25-0.50% above market rates because they know the incentive provides cover.

Market rate: 6.50% with $3k closing costs

Preferred lender: 7.00% with $10k closing credit

Reality: You pay extra monthly to “earn” your own incentive

On a $500k loan, that 0.50% rate difference costs about $130 monthly. Over 30 years, you’ll pay roughly $47k more in interest to “save” $7k upfront. The math rarely works in your favor unless you’re refinancing within 2-3 years.

Contract reality: Builders often require preferred lender pre-approval letters and make switching lenders after contract difficult with short notice periods and approval contingencies.

Spec homes vs to-be-built financing paths

Spec homes (completed or nearly complete) use standard mortgage financing with typical 30-45 day closings. You get limited customization but faster occupancy and simpler financing.

To-be-built homes require construction financing that converts to permanent financing when complete. This adds complexity: rate locks during construction, draw schedules, and change order management.

Construction-to-permanent (C2P) loans handle this with one application and closing, though you’ll usually pay slightly higher rates than separate construction and permanent loans. The trade-off: convenience vs potential savings.

Timeline reality: Triangle to-be-built homes typically take 4-7 months from contract to move-in, depending on customization level and builder schedule.

Construction-to-permanent vs builder financing

Most Triangle builders offer C2P financing through their preferred lenders. This streamlines paperwork but may limit your rate shopping during the construction period.

Alternative: Secure your own construction-to-permanent loan. This requires more coordination but gives you rate transparency and the ability to lock when rates are favorable during the construction timeline.

Builder financing benefits: They handle draw coordination, change orders flow smoothly, and any construction delays don’t affect your rate lock. Drawbacks: Less rate competition and potentially higher long-term costs.

Independent C2P benefits: Rate shopping flexibility, potentially better terms, and you control the lender relationship. Drawbacks: More coordination required and timing risk if construction delays push past your rate lock period.

Upgrade incentives: when they actually save money

Builder upgrade incentives sound appealing: “Use our preferred lender and get $15k toward granite counters and hardwood floors.” But upgrade pricing is typically marked up 40-100% over retail, and the $15k gets built into your home’s base price anyway.

The hidden cost: you’re financing inflated upgrades at mortgage rates for 30 years instead of paying retail prices upfront or doing improvements later. That $10k granite upgrade becomes $23k+ in total payments over the loan life.

Smart approach: Price popular upgrades independently, then calculate whether the incentive covers both the markup and the financing cost. Sometimes it does—especially on structural items like electrical or plumbing changes that are expensive to retrofit.

- Good upgrade bets: Electrical (outlets, lighting), plumbing rough-ins, structural changes, insulation upgrades

- Skip and DIY later: Paint, fixtures, appliances, flooring (unless hardwood subfloor prep is included)

- Calculate carefully: Windows, countertops, cabinets—markup varies widely by builder

Remember: the builder could simply reduce the home price by the incentive amount, but chooses not to because financing inflated costs generates more profit than transparent pricing.

Triangle builder landscape: what to expect

Major Triangle builders like DR Horton, Pulte, and Lennar typically offer substantial preferred lender incentives—often $5k-15k in credits or upgrades. Smaller custom builders may have less aggressive incentive programs but more negotiation flexibility.

Market reality: With Triangle inventory remaining tight and new construction demand strong, builders have less motivation to negotiate. However, end-of-quarter or end-of-fiscal-year timing can create opportunities.

Location note: Wake County has different permit timelines than Durham or Orange counties. Factor this into your construction timeline and rate lock planning.

FAQ

Usually no. Preferred lenders rarely offer best market rates, and incentives are built into home prices anyway. Compare true costs: preferred lender rates plus incentives vs market-rate lenders with lower home prices.

Spec homes are move-in ready with limited customization but faster closing. To-be-built offers full customization but requires construction-to-permanent financing and longer timelines.

Builders often offer upgrade credits tied to preferred lender use. Calculate the true cost—$10k in upgrades might cost you $15k in higher interest over the loan term.

C2P loans streamline the process with one closing but may have higher rates. Separate financing offers more flexibility but requires two closings and careful timing.

Want construction financing that fits your timeline?

I’ll map out C2P options and builder incentive math so you get the best deal—whether that’s preferred lender perks or independent financing. Clear comparison. Smart structure. No surprises.

Questions about construction loans? 984-289-6479 · wolff@michaelthebroker.com